There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

If you haven’t read the previous part of this series, you should first check that out, as this is the final blog that completes the psychological arc of triangle patterns.

👉 Read Part 2: Ascending Triangle –Pressure Builds from Below

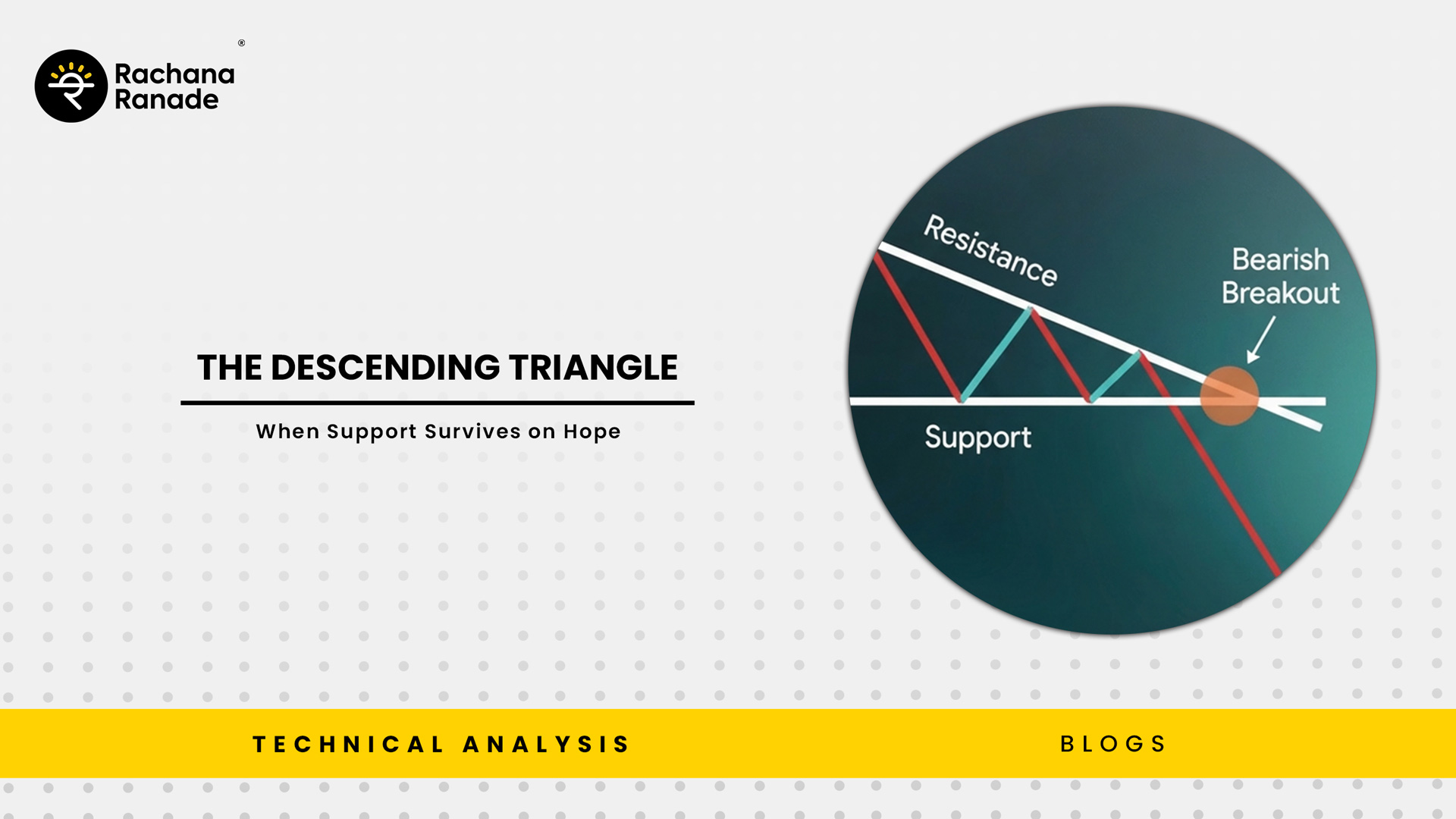

In the previous part, we saw how the ascending triangle reflects quiet persistence from buyers. The descending triangle tells the opposite story. It is not a pattern of panic or sudden fear. It is a pattern of gradual disengagement.

Identifying the Structure: When Stability Starts to Look Fragile

A descending triangle forms when price repeatedly finds support at the same level, while every rebound peaks lower than the previous one. On the surface, the support looks reliable. After all, it keeps holding. But the character of the rallies tells a different story. Each bounce attracts fewer participants, lasts for a shorter duration, and fails at a lower price. Sellers are no longer waiting for higher levels. They are willing to exit earlier, even if it means accepting less favorable prices.

Decoding the Sentiment: What the Market Is Really Communicating

This pattern reflects a market where demand still exists, but conviction is thinning. Buyers continue to defend a level, not because confidence is growing, but because there is no immediate reason to abandon it. Meanwhile, sellers are becoming less patient. Their behavior shifts first, not through aggressive selling, but through lower tolerance for risk. Volume often contracts during this phase, reinforcing the idea that participation is fading rather than accelerating. The market looks calm, but belief is slowly leaving the system.

The Psychological Shift: The Red-Pill Insight

Descending triangles are often described as bearish patterns, but fear is not the defining emotion here. Hope is. Support survives not because it is strong, but because it has not yet been challenged by a trigger. Once that level is tested decisively, there is very little conviction left to defend it. Markets don’t break because sellers suddenly become aggressive. They break because buyers quietly step aside.

Risk Management and Timing: Why Descending Triangles Matter

The significance of a descending triangle lies in its ability to reveal weakening participation before it becomes obvious. The pattern highlights where price is being held up by inertia rather than fresh demand. As the range tightens, reactions to new information become sharper, and once support fails, price tends to move quickly—not emotionally, but mechanically.

Conclusion: When Reality Overtakes Hope

The descending triangle does not announce trouble loudly. It waits.

And when it resolves, it does so not with drama, but with inevitability. For practice, check out these 3 stocks and find out if the same pattern exists in them: