There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

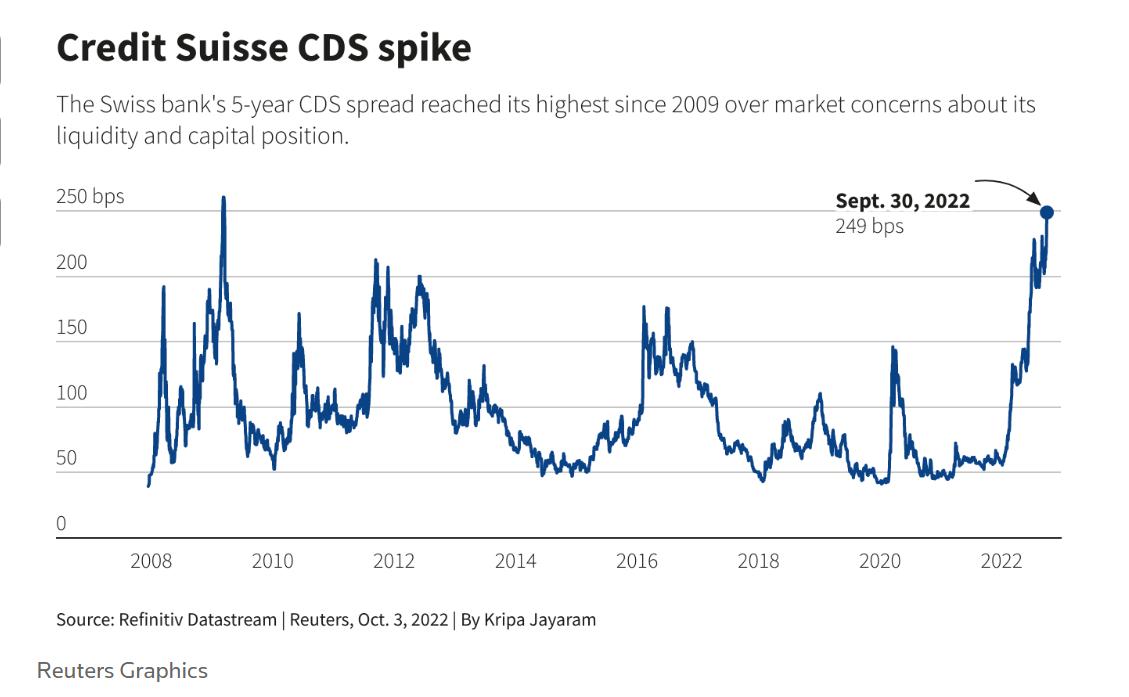

Credit Suisse, one of the world's largest banks, has recently been in the news for all the turmoil it is going through. The current financial health of the bank has worsened to the extent that experts and analysts have begun comparing it to the 2008 Lehman Brothers crisis.

But Why is Credit Suisse being compared with 2008 Lehman Brothers crisis? Before we move ahead, we need to understand what is “Credit Default Swap (CDS)” and “CDS Spread”

Suppose there is Company X, who has issued bonds to Investors. Among all Investors there is Investor Z, who thinks that Company X may not be able to honour the bond ( i.e. repay the Bond amount taken from Investor), hence he insures himself against this risk of default. Now the instrument through which the Investor Z (Buyer of CDS) protects himself against payment defaults is called Credit Default Swap (CDS).

And obviously the Insurer (Seller of CDS) would not insure the Investor for free, thus the Premium he charges for this is called CDS spread. This premium goes higher when there is high probability that the Issuer of Bond (Company X in our example) will default.

Analogy with 2008

How it started?

The bank is battling market skepticism about its financial health with a string of scandals, months after it was found guilty by Switzerland's Federal Criminal Court for failing to prevent money laundering. Well, we will not dig into that story, but there’s also some real concern about the bank’s risk management.

Take for instance the Greensill debacle, they were the largest non-bank provider of supply chain finance. And in a bid to service clients across the globe, they borrowed large sums of money from outside investors, including Credit Suisse. And when Greensill went bankrupt Credit Suisse suffered too.

There’s also the infamous Archegos Capital fiasco, here, a family office decided to gamble large amounts of money in picking risky stocks and eventually lost it all. However, since they financed these trades using money borrowed from Credit Suisse, the bank also faced the brunt. Because of all this turmoil going on, bank has reported net loss in all three recent quarters.

Is Credit Suisse just sitting & watching this

To combat this, Credit Suisse has come up with Restructuring plan (scheduled in late Oct 22) with a view to perform good in coming time. Though, on account of all the turbulence that it is facing & global recession fears it has to bear high cost of capital.

On 7th Oct, Credit Suisse announced that it would repurchase about $3 billion of bonds. With this a positive sentiment was sent in the market, that the Company is not facing a cash crunch & would not default on payments. On back of this news, its five-year CDS spread was down by 42 basis points & its stock price climbed over 7%.

JPMorgan analyst Kian Abouhossein, also stated that the group’s financial position at the end of the 2nd quarter was “healthy”, with a Common-Equity-Tier1 ratio (an indicator of its financial strength) of 13.5% and a liquidity coverage ratio of 191%. Just to give you a reference Union Bank of Switzerland’s Common-Equity-Tier 1 ratio was 14.2%, while Deutsche Bank’s was 13%.

How will this impact Indian market?

Like Lehman brother, Credit Suisse is regarded as too big to fail (Globally Systematically Important Banks). It operates in more than 50 countries. The whole world is connected & if the Credit Suisse defaults, it can bring the ripple effect all over globe, including India.

Well only time will tell that how Credit Suisse is able to manage the financial conundrum it’s facing.